Pay federal estimated taxes online 2021

How do I pay my 2021 estimated taxes online. As a partner you can pay the estimated tax by.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

To make estimated tax payments online first establish an account with the IRS at the EFTPS website.

. We dont file our 2021 returns until after Dec31 2021 next year. A taxpayer can either pay taxes online using a bank account or a debit or credit. Scheduling tax payments for 2020 and 2021 was a breeze.

The next estimated quarterly tax due date is Sept. Taxpayers whose adjusted gross income is 150000 or more must make a payment equal to 110 of the previous years taxes or 90 of the tax for the current year. Once you have an EFTPS account established you can schedule automatic.

You havent paid Estimates yet for 2021except for the first one that was due 2 days ago on April 15. One notable exception is if the 15th falls on a. April 17 2021 727 PM.

Based On Circumstances You May Already Qualify For Tax Relief. 425 57 votes The deadline for making a payment for the fourth quarter of. These individuals can take credit only for the estimated tax payments that they made.

Nonresident Alien Individuals can. The final quarterly payment is due January. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more.

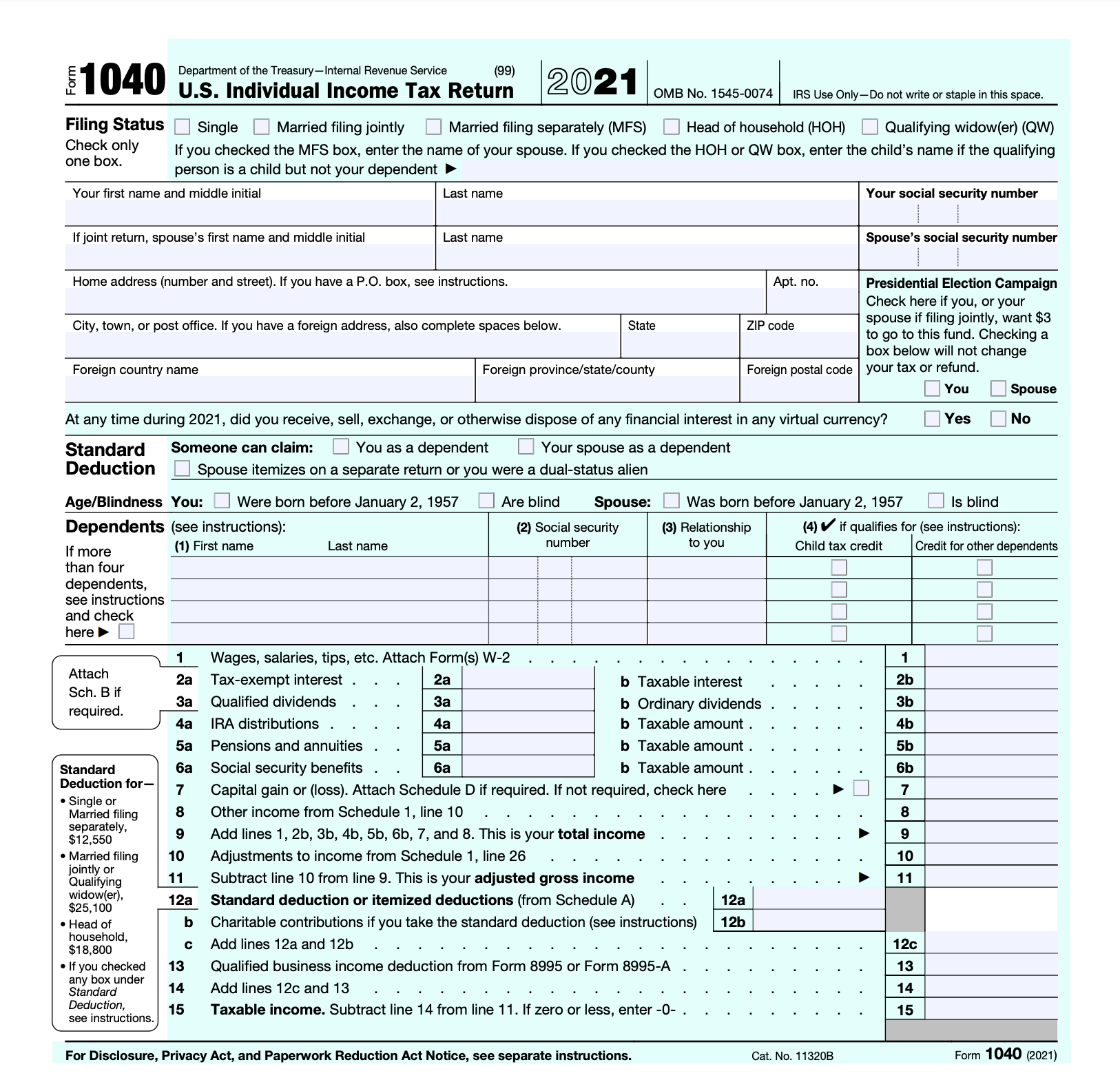

You do not have to indicate the month or quarter associated. Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021. Crediting an overpayment on your.

View 5 years of. Online file and pay file Form NC-40 and associated tax payment using the NCDOR website The deadline to file and pay your 2021 estimated taxes has passed. You can also make a guest payment without logging in.

Make your tax payment from. These individuals can take credit only for the estimated tax payments that they made-2-Form 1040-ES 2021 httpswwwirsgovAccount. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022.

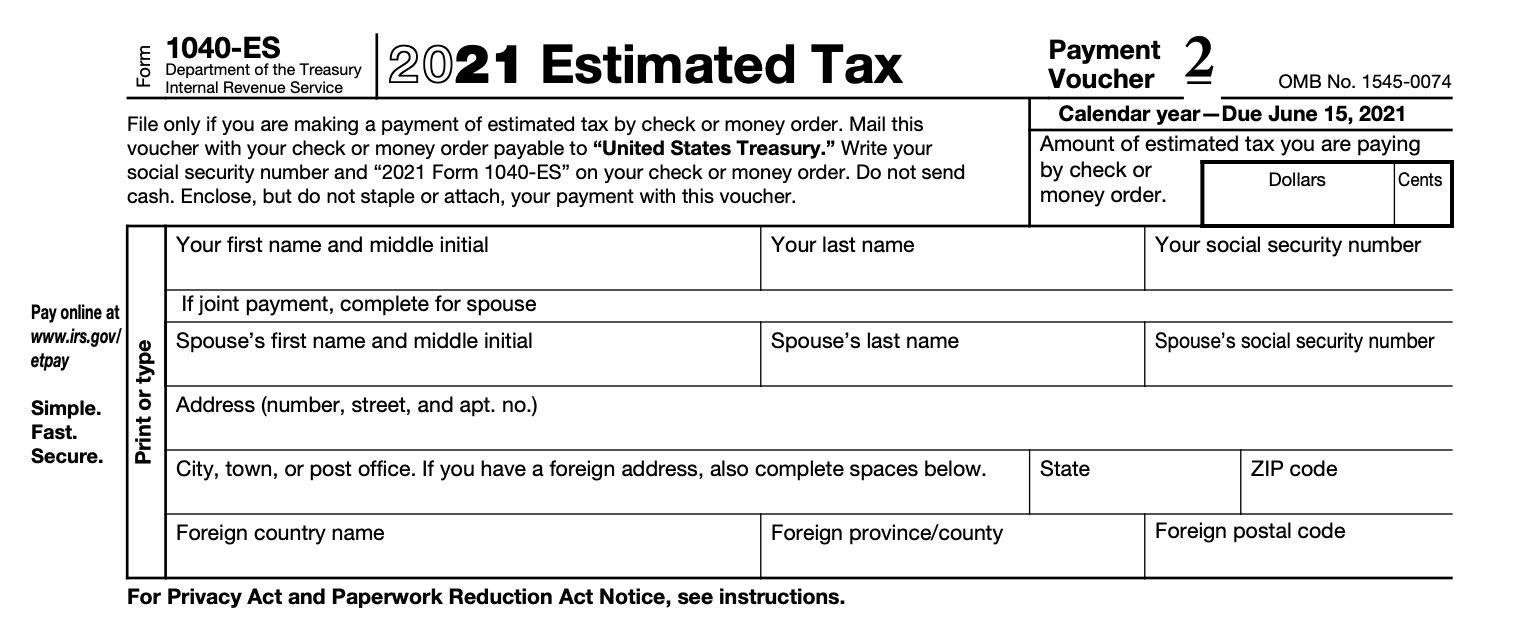

Make joint estimated tax payments. You can make 1040-ES estimated tax payments online at the IRS thus there is no need to e-File Form 1040-ES for the any of the quarters. Make a payment from your bank account or by debitcredit card.

Pay IRS installment agreements and other personal and business taxes quickly easily. 2021 Tax Return Filing Online. Pay your IRS 1040 taxes online using a debit or credit card.

Make and View Payments. You can pay all of your estimated tax by April. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

In 2021 estimated taxes are due on April 15 June 15 September 15. Income taxes are pay-as-you-go. Depending on your income your payment may be due quarterly or as calculated on Form 1040-ES Estimated Tax for Individuals.

Your household income location filing status and number of personal. Transition Tax - Tax Years 2019-2021. Make joint estimated tax payments.

The Internal Revenue Service allows taxpayers to pay taxes online in two different ways in 2021. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

Make Business Payments or Schedule Estimated Payments with the Electronic Federal Tax Payment System EFTPS For businesses tax professionals and individuals.

Fillable Form 637 Application For Registration Letter Activities Employer Identification Number Small Business Tax

How To Calculate Federal Income Tax

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

In A Letter The Aicpa Asked The Irs To Postpone Until June 15 2021 All 2020 Federal Income Tax And Information Returns A Tax Deadline Federal Income Tax Tax

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

3rd Quarter Form 941 Changes Irs Forms Payroll Taxes Irs

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Estimated Tax Payments Youtube

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

When Is The Form 941 Due For 2021 Due Date Irs Forms Form